Gather all your documentation

Gather all the documentation including T-slips, signed forms for specific deductions, documents for the deductions & credits you are entitled to …

You have better things to do that watch us work, drop off your tax return to 5148-53 street Drayton Valley & we will process your return, calculate all your deductions …

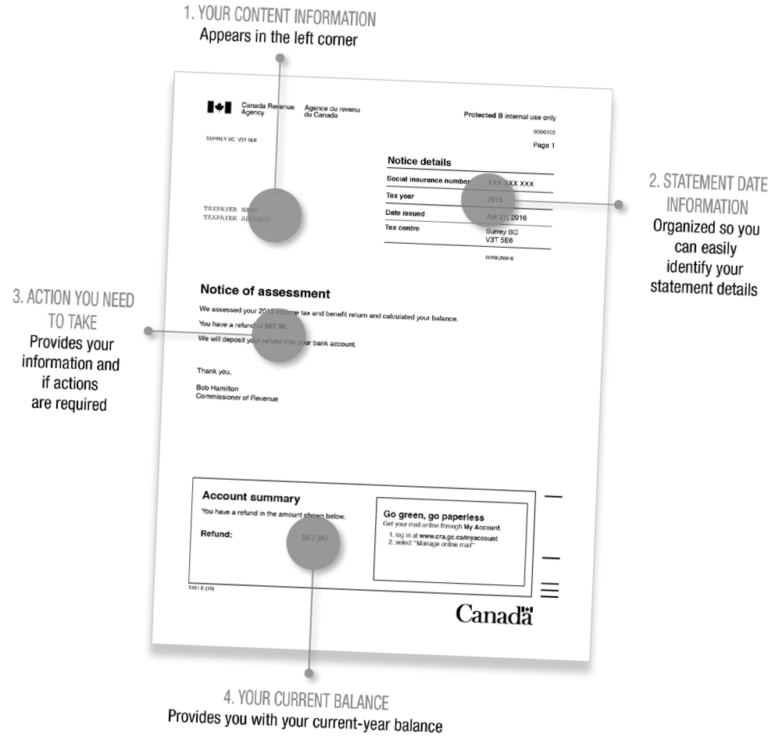

E-file & Direct Deposit Info.

For a faster refund let us e-file your return as well as your direct deposit information Register for a My Account with the CRA to access information about return.

Accounting, Compliance & Tax

Ready To File Your Personal Tax Returns – Registered as certified professionals with the Canada Revenue Agency and can assist with all aspects of your taxes, including Employment Expenses, Farm, Rental or Business. Whether you’re a freelancer, small business owner, farmer, or simply have a side hustle, we have the expertise to ensure that your tax return is completed with every effort to maximize your deductions and minimize your tax liability Our goal is to make tax season as stress-free as possible for you !

- All T-slips

- RRSP Contribution Slips

- Child Support Documents { prior to 1995 }

- Professional & Union Dues

- Employment Expenses ( Receipts )

- Medical Expenses

- Charitable Donation Reciepts

- Political Contribution Slips

- Child Care / Adoption Expenses

- Moving Expenses

- Tuition / Education Expenses ( Receipts )

- Northern Residents Deductions

You must keep all necessary receipts and documents as evidence to support your claims.

If you have any questions or concerns about what expenses can be claimed, please don’t hesitate to reach out to us to discuss the benefits & credits you may be entitled to.

As a business owner, you are well aware of the importance of managing not only your core operations but also your administrative responsibilities. Compliance with various accounting and tax regulations can be complex and time-consuming. Let us look after the paperwork, giving you more time to focus on what is important to you.

Personal Tax Returns

Gather all your documentation and drop your paperwork off at the office. 5148-53 st.

We will process your return and give you a call.

– NO APPOINTMENT NECCESSARY

Download PDF Fillable Forms

The Canada Revenue Agency has approximately 1.4 billion in cheques that have gone uncashed over the years. We want to make sure this money ends up where if belongs… In Taxpayers Pockets !

BUSINESS: 1-800-959-5525

– My Account Individual

PERSONAL 1-800-959-8281

– My Account Business

the Canada Revenue Agency isn't always right !

If you feel you are entitled to the deductions and or credits claimed, or feel the CRA has processed your information incorrect, we can assist you with your review, audit as well as filing an objection with the supporting documentation for a reassessment, determination or redetermination.

One of our Certified Professionals will work with the CRA on your behalf to resolve the issue. at a rate of $75 per hour.